Authorities of Rwanda, Tanzania and Uganda have agreed to a plan to electronically merge their stock markets.

This move is expected to cut the cost and logistical difficulties associated with cross-border stock trading.

The three countries will create a single stock exchange with a pooled market capitalization of around $15 billion.

This move is expected to incentivize investors and boost trading and investments in the countries.

The largest economy in East Africa and the home to the largest stock market with a market capitalization of $22 billion, Kenya, pulled out of the arrangement in 2015 due to procurement irregularities in the awarding of software contracts.

Even though Kenya is not part of the single stock market, it is still expected to have a presence as core Kenyan companies such as KCB Group, Equity Group as well as East African Breweries, among others will be prominently featured in the joint-stock exchange.

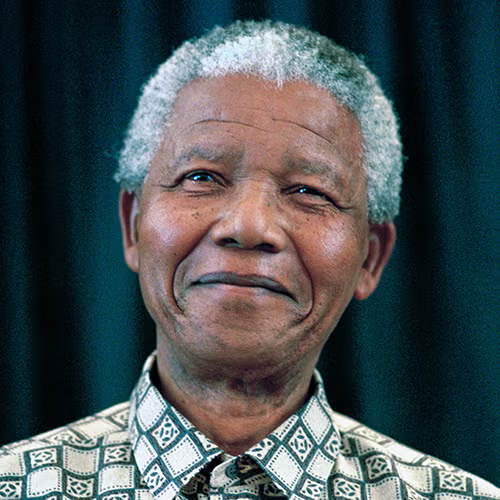

Dr Akinwunmi Adesina: AfDB President Acceptance Speech

Finastra Pilots Revolutionary Microfinance Initiative, Trust Machine, in Kenya

https://www.morganable.com/three-effective-no-fail-formulas-for-marketing-music/

https://www.morganable.com/joshua-knocks-out-pulev-in-the-ninth-round/

https://www.morganable.com/chinese-internet-giant-alibaba-listed-in-hong-kong/

https://www.morganable.com/monzo-taps-into-the-us-financial-market/

https://www.morganable.com/10-tips-to-managing-your-expectations-of-other-people/

https://www.morganable.com/controversial-tanzanian-president-dies-of-heart-attack-at-61/

When the project is completed, investors across the three countries will be able to trade in stocks without the existing administrative bottlenecks such as, but not limited to requiring stockbrokers operating within national boundaries, among others.

This project which is funded by the World Bank Group is expected to roll out operationally by December 2020.

The three countries have been working on the stock market merger for the past ten years culminating in the amalgamation of the three national stock exchanges.

According to African Market Data, 54 companies are listed on combined stock markets with 27 companies listed in Tanzania with a market capitalization of around $6.5bn, 17 companies are listed on the Ugandan Stock market with a market capitalization of around $5.1bn while 10 companies are listed on the Rwandan Stock Exchange with a market capitalization of around $3.5bn.

This merger is in line with the current happenings in the western region of Africa where Bourse Régionale des Valeurs Mobilières already exists.

The Abidjan-based electronic exchange which lists 45 companies is common to the eight member states of the West African Economic and Monetary Union—Benin, Burkina Faso, Guinea Bissau, Côte d’Ivoire, Mali, Niger, Senegal, and Togo.

The consolidation of smaller stock markets in Sub-Saharan Africa will create a mid-sized economy that will be liquid enough to attract major listing, thereby making the region more competitive and functionally supportive of young Africa-focused businesses such as Jumia, Mdundo, among others, to secure listing within the shores of Africa.

Most notable is the listing of Africa most valuable company, Cape-Town Based Naspers on Amsterdam’s Stock Exchange on the premise of a new company in order to access a wider fund pool, even though it is listed on the $1 Trillion Johannesburg Stock Exchange.